You would think the subject of money and how to handle it would be taught to everyone. Sadly, no. So, here’s a quick rundown in case you’ve missed it.

INFLATION

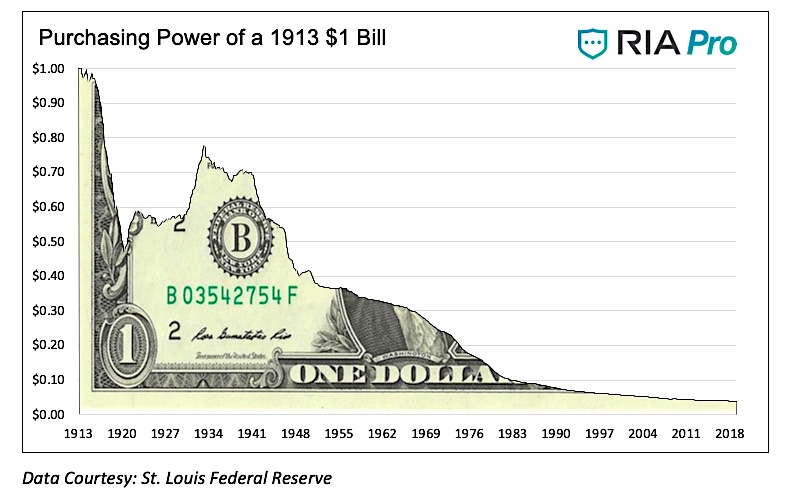

Purchasing power means how much your dollar can buy. If you can buy a month of groceries now for $600 and two years later the same groceries cost $1200, your dollars have lost half of their purchasing power! Not good.

According to the US Government Bureau of Labor Statistics[1], what $1 would have purchased in 1913 (when the Federal Reserve Bank was created) would have cost you $26.57 in October 2020. Put another way, your dollars have lost 96% of their value—purchasing power! (No wonder you feel like the harder you work, the “broker” you get.)

“Economic stimulus” is a fancy way of saying that governments are printing trillions more dollars with no value behind them. This has been done by many governments through history and today, Venezuela, Zimbabwe, Sudan, Iran, and Haiti are using printing presses rather than real production to try to handle their economic problems. This pushes prices up and purchasing power down.

Let me explain with this example. Sally and Jessica make the same amount of money at their work. They both have 4 dollars to spend on a loaf of bread, but there is only one loaf available. Bidding against one another for that one loaf, the most they can pay is $4. Now their economic stimulus checks arrive and they each have $16. Unfortunately, there aren’t any more loaves of bread produced, so they have bid against one another. So that one loaf of bread will cost $16. That is inflation: more money chasing the same number of things to buy.

Few people recognize the cause of the dollar’s decline. This is because most people work for a living. Wage and salary increases help to adjust to the inflation that is created. (Make no mistake. It is created by central bankers. It doesn’t just happen.) So inflation affects savings more than current income.

What would a financial system look like that didn’t include inflation? Better yet, what if it actually made the money saved more valuable instead of less valuable?

BITCOIN

Instead of the increasing number of dollars, the number of Bitcoins Is fixed at 21 million. There will never be more. So far, 18.5 million have been created, but the speed of creating the rest of the Bitcoins is cut in half every 4 years. That means it will take 120 more years to create all 21 million. This reduction in Bitcoin production is based on rules set in the original program and can’t be changed. No inflation means the value of your savings will be preserved or grow and not be worth less and less. You can preserve and accumulate wealth.

THE 2017 BITCOIN BUBBLE

The date when Bitcoin production is reduced by half is called the Halving. So far, there have been three: 2012, 2016 and 2020. Each one of these makes Bitcoin more scarce and has historically sent the price of Bitcoin higher … much higher. 2017 saw the price hit almost $20,000.

WHY 2021 WON’T BE A BUBBLE

In 2017 people were seeing the dramatic rise in Bitcoin’s price and wanted to make a profit and then take that profit—convert it to dollars.

This year we’ve seen billionaires and the first public corporations (among them Square and Paul Tudor Jones) buy tens of millions of dollars of Bitcoin as a protection of their savings . They are not going to sell their Bitcoin for a quick profit because they want a store of value for their accumulated savings. They want their wealth protected from inflation and not worth less and less while they hold it. They won’t be dumping Bitcoin like the speculators did after the 2017 bubble. This will keep the price of Bitcoin stable at these higher levels.

References

- HODL* FOMO* vs. Speculative FOMO*, Nathaniel Whittemore, https://nlwcrypto.libsyn.com/hodl-fomo-vs-speculative-fomo-why-this-bull-market-will-be-different expanding on Brady Swenson’s Tweet “HODL FOMO = Escape Velocity*” https://twitter.com/CitizenBitcoin/status/1327276810363670529

- *HODL – Hold on for Dear Life = Buying an investment for the long term, not to make a quick profit and get out

- *FOMO – Fear Of Missing Out = Everyone else is getting rich and I don’t want to miss the boat on this opprotunity

- *HODL FOMO – Fear Of Missing Out on a life-changing long-term investment

- *Speculative FOMO – Fear Of Missing Out on a quick chance to get rich

- *Escape Velocity – The speed necessary to allow a rocket to escape Earth’s gravity and get into space, used here to mean Bitcoin’s going way, way beyond any previous highs and not come back to this price range

- “The One Strange Thing About This Bitcoin Rally” by Scott Chipolina. https://decrypt.co/48641/the-one-strange-thing-about-this-bitcoin-rally